The EU Green Deal puts strong emphasis on the development of Offshore Renewable Energy, as a key source of electricity in a climate-neutral Europe. This article presents the JRC analysis on the status of offshore renewable energy technologies and their markets and identifies cooperation and sustainable management of the maritime space as key to increase deployment.

Technology readiness and current deployment of the offshore renewable energy technologies differ strongly.

Offshore wind technology dominates the renewable offshore sector. The technology is already commercially available, using foundations and horizontal axis wind turbines (6.2 MW average turbine capacity in 2019), operating predominantly in shallow waters (<60m depth). The European offshore wind market (EU27) represents 42% (12.2 GW) of the global market in terms of cumulative installed capacity followed by the United Kingdom (9.7 GW) and China (6.8 GW).

Notably, most of the operational capacity as well as the foreseeable project pipeline for the EU is located in the North and Baltic Sea basins were the market is already established.

Although still nascent, there are notable projects of floating wind (operating in deeper waters) such as Hywind Scotland (UK), Floatgen (FR) and WindFloat Atlantic (PT), and another 320 MW are expected to be commissioned by 2024. Developers pursue different floating designs, varying the buoyancy concept of the substructure (Spar-buoy, Semi-Submersible, Tension-Leg Platform, Barge or Multi-Platforms). So far, no concept has prevailed over the others1.

Ocean energy technologies start becoming more competitive. European R&I is still the main driver making Europe the leader in wave and tidal technologies. Ongoing demonstration projects are showing significant progress in terms of technology validation and prove that cost-reduction is possible2.

Floating offshore photovoltaics (PV) are still at the early stage development with first demonstrators being tested offshore in the Netherlands (Oceans of Energy; TNO/Crosswind), France (HelioRec) and Italy (Saipem).

The commercialisation of offshore renewables will depend on several interacting factors: overcoming existing technological challenges, cost competitiveness, system integration value, policy support schemes and national deployment targets3. The European Strategic Energy Technology Plan (SET-Plan) is implementing concrete actions to achieve cost reduction targets by 2030. Costs of floating offshore wind are still at the higher end (200-250 EUR/MWh) given the technology's infancy. However, developers of floating offshore wind projects estimate significant cost reduction to about 50 EUR/MWh by 2030, if installed capacities reach ambitious values between 12-15 GW.

Significant cost reduction is still vital for tidal and wave energy technologies to meet the SET-Plan targets of 100 EUR/MWh by 2030 and 2035 respectively. Ongoing demos have proved that these targets are within the reach, yet more demonstration projects are needed for further cost reduction.

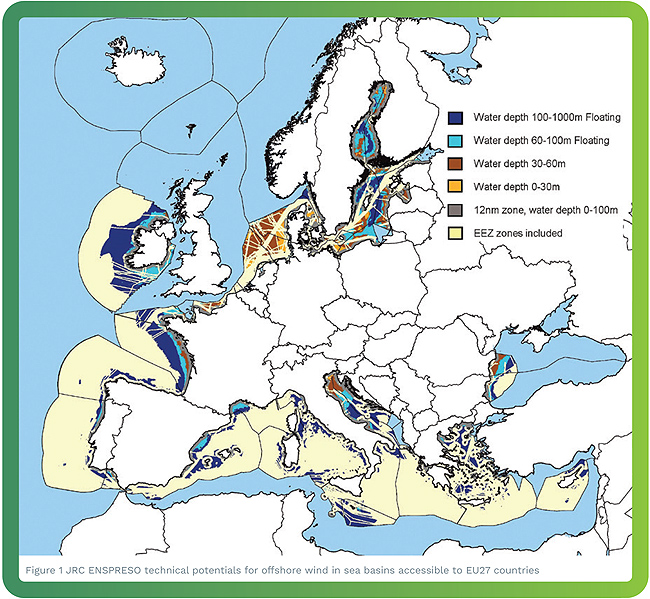

The EC long-term vision towards carbon neutrality4 notes that an offshore wind capacity between 396 GW and 451 GW can be expected by 2050. This would require significant investments ranging between 660-770 BEUR from 2030 onwards5. Against this backdrop, offshore renewable energies offer an opportunity for sustained growth to EU Member States. Analysing the JRC ENSPRESO dataset6 per sea basin shows that technical potentials for offshore wind in EU27 EEZ7 zones are highest in the Atlantic Ocean (1447 GW) followed by the Mediterranean Sea (1445 GW), Baltic Sea (1183 GW), North Sea (437 GW) and the Black Sea (160 GW) (see Figure 1). Areas with sea depths necessitating the deployment of floating offshore wind are vast (2468 GW) and promising for countries with steeper coastlines (Atlantic Ocean (1066 GW) and Mediterranean Sea (819 GW)). The floating offshore potential of the EU27 in the North Sea is limited to 30 GW. Still the North Sea (284 GW) and the Baltic Sea (225 GW) offer most of the technical potential for projects in shallower waters (up to 60m depth and outside the 12nm-zone).

The EU Offshore strategy is expected to frame the opportunity to expand the success of offshore wind to new European markets and develop technological leadership in new emerging technologies. However, this might need long-term indicative capacity targets for each European sea basin upfront to develop future supply chains.

If the targeted capacities in the EU27 follow the distribution of the technical potentials, 36% would be deployed in the Atlantic Ocean, 28% in the Mediterranean Sea, 22% in the Baltic Sea, 10% in the North Sea, and 4% in the Black Sea8.

The industry's vision for offshore wind in 2050 orientates itself along the 450 GW target of the long-term strategy towards climate neutrality by 2050 for the Union. In this case, the European countries would deploy 47% of the capacity in the North Sea followed by the Atlantic Ocean9 (19%), the Baltic Sea (18%) and the Southern European waters (16%)10. Moreover, the ocean energy industry targets 100 GW of capacity by 2050.

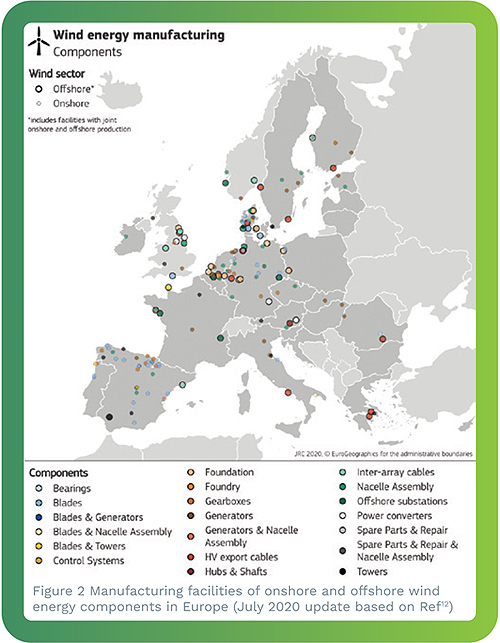

The European supply chain for wind energy components is located in countries that can be considered first movers or innovators (Denmark) and in those developing a strong home market for onshore wind (Germany, Spain).

So far offshore wind OEMs located their factories mainly around the North Sea and Baltic Sea; however, suppliers of subcomponents can be found all over Europe, even in landlocked countries (see Figure 2).

A bold offshore renewable energy strategy will establish the relevance of the Offshore Wind and Ocean Energy sector, not only as key provider of clean electricity, but also as strategic industrial asset that could leverage EU technological leadership, drive trade and generate an estimated 1.2-2.8 million job person-years by 205011.

Contact details:

European Commission, Joint Research Centre,

P.O. Box 2

1755 ZG Petten,

The Netherlands

Tel: +31 (224) 56-5222

Email: thomas.telsnig@ec.europa.eu

EU Science Hub: https://ec.europa.eu/jrc

1. JRC 2020, Technology Development Report Wind Energy, JRC120709

2. JRC 2020, Technology Development Report Ocean Energy, 2020 Update, JRC210872

3. Based on a JRC review of National Energy and Climate Plans (NECPs) performed at the beginning of July 2020 eight countries reported a cumulated offshore capacity target of about 55GW

4. In-depth analysis in support on the COM(2018) 773

5. Capros et al. 2019, https://doi.org/10.1016/j.enpol.2019.110960

6. 2019, JRC: ENSPRESO - WIND - ONSHORE and OFFSHORE. European Commission, Joint Research Centre (JRC) [Dataset] PID: http://data.europa.eu/89h/6d0774ec-4fe5-4ca3-8564-626f4927744e

7. Exclusive Economic Zone. Technical potentials include the territorial waters (12nm-zone) and areas with a water depth down to 1000m. For detailed restrictions on the technical potentials please refer to the JRC ENSPRESO dataset

8. These figures exclude the territorial waters (12 nautical mile zone) of the exclusive economic zone (EEZ)

9. Excludes the Atlantic coast of Spain and Portugal, which are ascribed by BVG Associates/WindEurope (2019) to the Southern European waters

10. BVG Associates/WindEurope 2019, Our energy, our future – How offshore wind will help Europe go carbon-neutral

11. Assuming country-level employment factors (direct and indirect) ranging from of 2.1 to 5.1FTE/MWinstalled by 2050. Based on results of econometric models (Ortega et al. (2020) and WindEurope/Deloitte (2019))

12. JRC 2019, Wind Energy Technology Market Report, doi:10.2760/223306, JRC118314